Large language models (LLMs) are transforming how we interact with data—but in finance, high-quality, domain-specific language models have largely remained behind proprietary walls. Enter FinGPT, an open-source initiative under the AI4Finance Foundation that democratizes access to internet-scale financial data and provides modular, transparent tools for building financial LLMs (FinLLMs).

Unlike closed systems such as BloombergGPT, which rely on exclusive internal datasets, FinGPT adopts a data-centric philosophy: it doesn’t just offer a pre-trained model—it gives you the full pipeline to gather, curate, and use real-world financial text from diverse global sources. Whether you’re a researcher prototyping a sentiment analyzer, a developer building a robo-advisor, or a student exploring algorithmic trading signals, FinGPT empowers you with reproducible, community-driven infrastructure—no vendor lock-in, no black boxes.

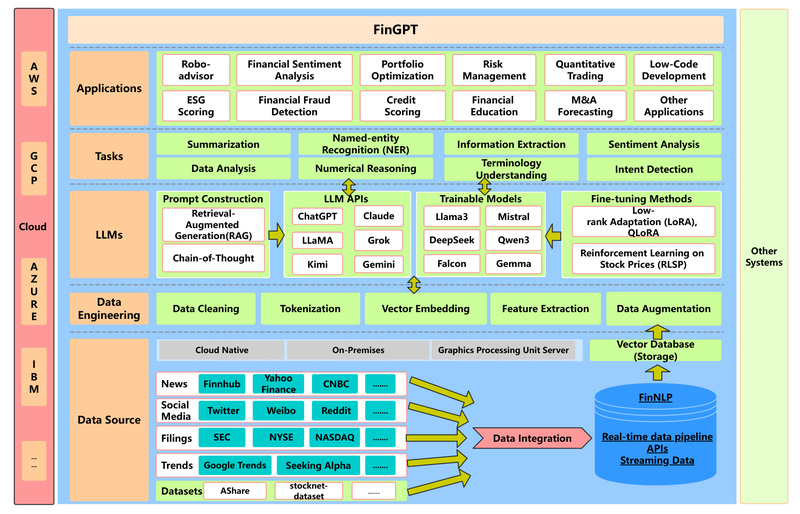

Built around the FinNLP repository, FinGPT supports seamless data collection from U.S. and Chinese markets alike, covering news, social media, and official company filings. Coupled with lightweight fine-tuning techniques like low-rank adaptation (LoRA), it enables efficient, domain-adapted models without massive compute budgets.

Why FinGPT Stands Out in Financial NLP

Full Transparency and Open-Source Accessibility

FinGPT is fully open-source under the MIT license, providing both code and data pipelines. This stands in stark contrast to commercial alternatives that offer APIs but hide training data, curation logic, and model architectures. With FinGPT, every step—from data ingestion to fine-tuning—is inspectable, modifiable, and reproducible.

Automated, Multi-Source Data Curation

At the heart of FinGPT is its automated data pipeline, which aggregates financial text from dozens of real-world sources:

- News: Finnhub (aggregating Yahoo Finance, Reuters, CNBC, Seeking Alpha), Sina Finance, Eastmoney

- Social Media: StockTwits, Reddit (r/WallStreetBets), Weibo

- Official Filings: SEC (U.S.) and Juchao (China)

Each source is wrapped in a simple downloader class. For example, gathering U.S. stock news between two dates requires just three lines of Python:

from finnlp.data_sources.news.finnhub_date_range import Finnhub_Date_Range

downloader = Finnhub_Date_Range({"token": "YOUR_TOKEN"})

downloader.download_date_range_stock("2023-01-01", "2023-01-03")

The same pattern applies to Chinese markets, social sentiment, or regulatory disclosures—enabling cross-market, multimodal financial analysis out of the box.

Global Coverage: U.S. and Chinese Markets

Many financial NLP tools focus exclusively on English-language data. FinGPT breaks this limitation by offering first-class support for Chinese financial text, including Sina Finance news, Eastmoney stock updates, and Juchao regulatory filings. This dual-market design makes it uniquely suited for comparative studies, global sentiment modeling, or multinational fintech applications.

Lightweight Fine-Tuning with LoRA

FinGPT leverages low-rank adaptation (LoRA) to fine-tune large models efficiently. This means you can adapt powerful base models (like LLaMA or ChatGLM) to financial tasks with minimal GPU memory and training time—critical for labs or startups without access to enterprise-scale infrastructure.

Practical Applications Enabled by FinGPT

FinGPT isn’t just a research artifact—it’s engineered for real-world utility:

- Robo-Advising: Train assistants that answer investor queries using up-to-date news and filings.

- Sentiment-Driven Trading Signals: Build models that ingest StockTwits or Weibo posts to detect market-moving sentiment shifts.

- Low-Code Financial Apps: Rapidly prototype dashboards that summarize SEC filings or generate earnings call highlights.

- Cross-Market Analysis: Compare how a macro event (e.g., interest rate changes) is reported in U.S. vs. Chinese media.

Because FinGPT provides structured, timestamped text data with minimal preprocessing, you can plug it directly into training loops for classification, generation, or retrieval-augmented systems.

Getting Started: A Typical Workflow

- Choose a data source: Decide whether you need U.S. news (Finnhub), Chinese social media (Weibo), or regulatory texts (SEC/Juchao).

- Configure credentials: Most U.S. sources require a free API token (e.g., from Finnhub); Chinese sources may need login cookies for full access.

- Download and extract: Use the provided downloader classes to fetch headlines, content, and metadata into a pandas DataFrame.

- Fine-tune or infer: Feed the cleaned data into your LLM pipeline—whether for supervised training, prompt engineering, or retrieval-augmented generation.

This workflow is designed for rapid iteration: you can go from zero to a domain-specific dataset in minutes, not weeks.

Limitations and Practical Notes

FinGPT excels as a data and pipeline foundation—but users should be aware of its boundaries:

- Not a ready-to-use chatbot: FinGPT provides data and examples, not a deployable financial assistant. You’ll need to train or integrate your own model.

- API dependencies: Access to some sources (e.g., Finnhub, Weibo) requires external accounts or tokens. The project handles data fetching logic, but not credential provisioning.

- Incomplete source coverage: A few listed platforms (e.g., Yicai, CCTV) are marked “coming soon” and may not yet be fully implemented.

- Compliance is user-managed: Rate limits, proxy rotation, and data usage policies must be handled per the source’s terms—FinGPT provides tools but not legal guarantees.

These are standard considerations for open financial data projects, not shortcomings of FinGPT itself.

Summary

FinGPT solves three critical pain points in financial AI:

- Data scarcity—by offering automated pipelines to internet-scale, real-world financial text.

- Reproducibility gaps—by open-sourcing every component of the data-to-model workflow.

- Market bias—by supporting both U.S. and Chinese financial ecosystems in a unified framework.

For researchers, developers, and educators seeking a transparent, community-backed alternative to proprietary FinLLMs, FinGPT is not just an option—it’s a catalyst for innovation in open finance.