In the era of foundation models, most time series approaches have been adapted from general-purpose architectures originally designed for language or vision. While effective in controlled domains, they often fall short when applied to the chaotic, noisy, and highly non-stationary world of financial markets. Enter Kronos—the first open-source foundation model explicitly built for financial candlestick (K-line) data. Trained on over 12 billion K-line records spanning 45 global exchanges, Kronos treats financial time series as a structured “language” and learns its grammar, rhythm, and semantics through large-scale pre-training.

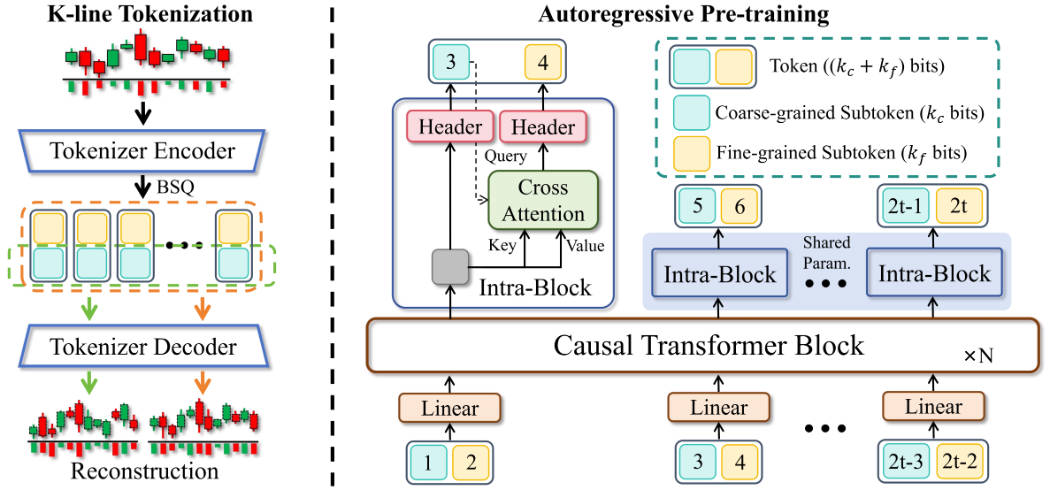

Unlike off-the-shelf Time Series Foundation Models (TSFMs), Kronos doesn’t just ingest raw OHLCV values—it first converts them into hierarchical discrete tokens using a purpose-built tokenizer that preserves both price dynamics and trading activity patterns. This two-stage design enables Kronos to unify diverse downstream tasks—from price prediction to synthetic data generation—within a single, scalable autoregressive Transformer architecture.

For quantitative researchers, algorithmic traders, and fintech engineers, Kronos solves three persistent pain points: unreliable price forecasts, poor volatility modeling, and the lack of realistic synthetic market environments for testing. And with multiple pre-trained variants available on Hugging Face, it’s ready to use out of the box—no re-architecting required.

Why Financial Markets Need a Specialized Foundation Model

Generic time series models treat all temporal signals similarly—whether it’s temperature readings, heartbeats, or stock prices. But financial data is fundamentally different. It exhibits regime shifts, fat-tailed distributions, microstructure noise, and cross-asset dependencies that generic models fail to capture.

Kronos addresses this by being finance-native from the ground up. Its tokenizer doesn’t merely quantize prices; it encodes multi-dimensional candlestick features (open, high, low, close, volume, amount) into tokens that reflect market semantics—such as breakout patterns, consolidation phases, or volume spikes. This allows the Transformer backbone to learn financial “phrases” and “sentences” rather than just statistical correlations.

As a result, Kronos excels in zero-shot settings across tasks that matter to practitioners—without task-specific fine-tuning. This domain-aware design is why it significantly outperforms both existing TSFMs and non-pre-trained baselines.

Core Capabilities That Deliver Real-World Value

1. Accurate Price Forecasting with Strong RankIC Gains

Kronos achieves a 93% improvement in RankIC over the leading Time Series Foundation Model and 87% over the best non-pre-trained baseline. RankIC (Rank Information Coefficient) measures the monotonic relationship between predicted and actual returns—a critical metric in quantitative finance. Higher RankIC means better signal ranking, which directly translates to more profitable alpha strategies.

2. Precise Volatility Prediction

Volatility is central to risk management, option pricing, and position sizing. Kronos reduces Mean Absolute Error (MAE) in volatility forecasting by 9% compared to prior art. This reliability enables more robust portfolio construction and dynamic hedging.

3. High-Fidelity Synthetic K-Line Generation

Stress-testing trading strategies requires realistic market scenarios—especially under rare or extreme conditions. Kronos generates synthetic K-line sequences with 22% higher generative fidelity, preserving statistical properties like autocorrelation, volatility clustering, and price-volume relationships. This makes it invaluable for backtesting, data augmentation, and adversarial robustness evaluation.

Practical Use Cases Where Kronos Shines

- Algorithmic Signal Generation: Use Kronos to predict future OHLCV trajectories and derive directional or mean-reversion signals for systematic trading.

- Cross-Asset Risk Modeling: Leverage its multi-market pre-training to model volatility spillovers across equities, forex, and crypto.

- Synthetic Market Simulation: Generate realistic yet diverse market paths for strategy validation without overfitting to historical data.

- Unified Infrastructure: Replace multiple task-specific models with a single Kronos instance that handles forecasting, generation, and inference across instruments and timeframes.

Getting Started: Simple, Production-Ready API

Kronos is designed for immediate usability. With just a few lines of Python, you can generate forecasts:

- Load a pre-trained model and tokenizer from Hugging Face.

- Pass a pandas DataFrame with

['open', 'high', 'low', 'close'](volume and amount are optional). - Specify historical and future timestamps.

- Receive a forecasted DataFrame with all six K-line fields.

The KronosPredictor class handles normalization, tokenization, inference, and inverse transformation automatically. For scale, the predict_batch method enables parallel forecasting across multiple assets, with built-in GPU acceleration and independent per-series processing.

Advanced users can also control probabilistic forecasting via temperature (T) and nucleus sampling (top_p), enabling ensemble-style predictions or uncertainty quantification.

Model Variants and Practical Considerations

Kronos offers four model sizes to match different resource constraints:

| Model | Parameters | Context Length | Use Case |

|---|---|---|---|

| Kronos-mini | 4.1M | 2048 | Low-resource experimentation |

| Kronos-small | 24.7M | 512 | Balanced performance & speed |

| Kronos-base | 102.3M | 512 | High-accuracy research |

| Kronos-large | 499.2M | 512 | State-of-the-art production |

Important: The small, base, and large variants have a maximum context length of 512. Input sequences longer than this will be truncated. Design your lookback window accordingly (e.g., 400–500 steps for 5-minute data).

While OHLC is mandatory, volume and amount can be omitted—the model will impute zeros and still produce meaningful forecasts.

For domain-specific markets (e.g., Chinese A-shares), Kronos provides a complete fine-tuning pipeline using Qlib, including data preprocessing, multi-GPU training for both tokenizer and predictor, and a simple backtesting framework.

From Prototype to Production: What’s Included vs. What You Build

Kronos delivers a fully functional research and prototyping toolkit: pre-trained models, predictor APIs, batch inference, fine-tuning scripts, and a backtesting demo. However, deploying it in live trading requires additional components:

- Portfolio optimization to convert raw forecasts into position weights.

- Risk factor neutralization (e.g., sector, market beta) to isolate pure alpha.

- Transaction cost and slippage modeling for realistic backtests.

The provided Qlib-based backtest is intentionally simplified—it demonstrates feasibility, not production readiness. But it gives you a solid, validated starting point to build upon.

Summary

Kronos redefines what’s possible in financial time series modeling by treating candlestick data as a formal language and learning it at scale. It’s not just another TSFM—it’s a finance-first foundation model that delivers measurable improvements in forecasting, risk estimation, and synthetic data quality. With open-source availability, Hugging Face integration, and a user-friendly API, Kronos lowers the barrier to entry for both academic research and industrial applications. Whether you’re prototyping a new trading signal or simulating market stress scenarios, Kronos provides a unified, robust, and scalable foundation.