Automated financial trading has long relied on rule-based systems or single-agent machine learning models that struggle to capture the nuanced, collaborative nature of real-world trading firms. Enter TradingAgents—an open-source, multi-agent framework powered by large language models (LLMs) that simulates the full ecosystem of a professional trading desk. Designed explicitly for research and prototyping, TradingAgents decomposes complex market analysis into specialized roles, enabling agents to debate, synthesize, and validate insights before any trade is executed.

This framework isn’t just another backtesting tool. It’s a structured environment where fundamental analysts, sentiment experts, technical forecasters, risk managers, and portfolio decision-makers interact dynamically—just like in elite trading firms. By leveraging the reasoning power of modern LLMs within a modular, debate-driven architecture, TradingAgents delivers more robust, interpretable, and context-aware trading signals than traditional single-agent approaches.

Why Collaboration Matters in Automated Trading

Most existing AI trading systems operate in isolation: one model ingests data and outputs a buy/sell signal. This “siloed” design ignores a critical truth of professional finance—decisions are rarely made by a single expert. Instead, traders rely on cross-functional teams: analysts scrutinize earnings reports, quants track volatility regimes, and risk officers enforce capital constraints.

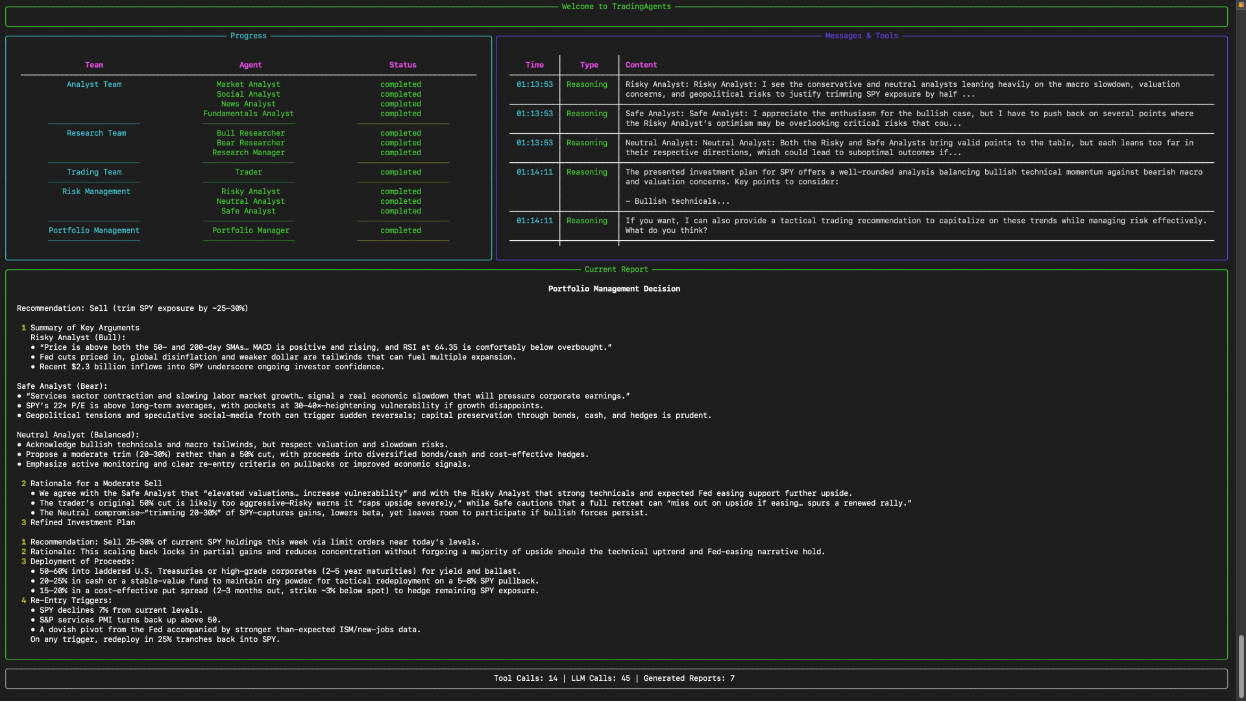

TradingAgents replicates this collaborative workflow through a carefully orchestrated agent society:

- Analyst Team:

- Fundamentals Analyst evaluates balance sheets, cash flows, and valuation metrics.

- Sentiment Analyst processes social media and news sentiment to gauge market mood.

- News Analyst interprets macroeconomic events and geopolitical risks.

- Technical Analyst applies indicators like RSI and MACD to identify price patterns.

- Researcher Team:

Comprising Bull and Bear agents, this group engages in structured debates, challenging each other’s assumptions to balance optimism against downside risk. - Trader Agent:

Synthesizes all inputs into a coherent trade proposal—specifying direction, size, and timing. - Risk Management & Portfolio Manager:

The risk team continuously monitors exposure, liquidity, and volatility. Only after their review does the Portfolio Manager approve or reject the trade, mimicking real-world governance.

This layered, consensus-driven process significantly reduces overconfidence and blind spots—common failure modes in single-agent systems.

Solving Real Pain Points in AI-Driven Finance

TradingAgents directly addresses several persistent challenges in algorithmic trading research:

- Lack of Diverse Perspectives: Single models often overweight one data type (e.g., price history) while ignoring fundamentals or sentiment. TradingAgents forces integration across modalities.

- Poor Risk Awareness: Many AI traders optimize for returns without explicit risk controls. Here, risk management is a first-class agent with veto power.

- Black-Box Decisions: Because agents generate natural language reports and debate rationales, every decision is explainable—critical for research validation and iterative improvement.

- Fragile Generalization: By simulating market conditions through multi-agent interaction, the system adapts more gracefully to regime shifts than static models.

Extensive experiments show that this approach consistently outperforms baselines in cumulative returns, Sharpe ratio, and maximum drawdown—key metrics for any serious trading strategy.

Who Should Use TradingAgents—and How

TradingAgents is ideal for:

- Academic researchers studying multi-agent collaboration, LLM reasoning, or financial decision-making.

- Fintech developers prototyping next-generation trading assistants or agent-based advisory systems.

- Educators and students demonstrating how AI can emulate institutional workflows in finance.

- Quant teams exploring hybrid human-AI trading desks or stress-testing strategy robustness.

Importantly, TradingAgents is not intended for live production trading or as financial advice. It’s a research sandbox—designed for simulation, backtesting, and hypothesis testing under controlled conditions.

Getting started is straightforward:

- Clone the repository and set up a Python environment.

- Provide OpenAI and Alpha Vantage API keys (free tiers are supported).

- Run via CLI for interactive exploration or integrate the

TradingAgentsGraphclass directly into your Python code.

The system is highly configurable: swap LLMs (e.g., use cost-efficient gpt-4o-mini for testing), adjust debate depth, or switch data vendors (yfinance, Alpha Vantage, or local files). This flexibility lets you balance performance, cost, and data fidelity based on your use case.

Limitations and Practical Considerations

While powerful, TradingAgents comes with important caveats:

- API Dependency: Performance relies on external services (OpenAI for reasoning, Alpha Vantage for data). Rate limits and costs can accumulate quickly during large-scale backtests.

- Non-Deterministic Outputs: Like all LLM systems, results vary with temperature, prompt engineering, and market context. Repeated runs may yield different decisions.

- Research-Grade Only: The framework includes simulated execution—not real order routing. Never deploy it in live trading without rigorous validation.

- Local Data Support (Tauric TradingDB): An offline dataset for backtesting is under development but not yet publicly released.

These constraints are clearly acknowledged by the authors, reinforcing the project’s commitment to responsible, transparent AI research.

Summary

TradingAgents represents a significant step toward replicating the collaborative intelligence of professional trading firms using LLM-powered agents. By structuring analysis, debate, risk review, and final approval into distinct, interacting roles, it overcomes key limitations of single-agent systems—offering richer insights, better risk control, and greater interpretability. For researchers and developers exploring the frontier of multi-agent AI in finance, it’s not just a tool—it’s a blueprint for the future of algorithmic decision-making.

Available under an open-source license at GitHub, TradingAgents invites the community to build, extend, and validate this novel paradigm in financial AI.