Financial markets are among the most complex and noisy environments for deploying reinforcement learning (RL) agents. Unlike simulated games or controlled robotics tasks, real-world trading data is messy, non-stationary, and riddled with biases—making it exceptionally difficult to develop, train, and validate robust RL strategies. Enter FinRL-Meta, an open-source, data-centric library designed to solve precisely these challenges.

Developed and actively maintained by the AI4Finance Foundation, FinRL-Meta provides a standardized, gym-style interface to hundreds of real-world financial market environments. It automates the heavy lifting of data curation, preprocessing, and environment construction, so researchers and practitioners can focus on what matters most: designing better trading strategies. Whether you’re reproducing academic papers, backtesting across global markets, or preparing for a competition like ACM ICAIF, FinRL-Meta offers a reproducible, transparent, and extensible foundation for data-driven financial reinforcement learning.

Why FinRL-Meta Solves Real Pain Points

Traditional approaches to financial RL often start with fragmented data sources, manual feature engineering, and ad-hoc environment setups. This not only slows down research but also introduces inconsistencies that make fair comparisons between algorithms nearly impossible. Worse, historical backtests frequently suffer from survivorship bias, lookahead leakage, or unrealistic assumptions—leading to strategies that fail in live trading.

FinRL-Meta directly addresses these issues through three core innovations:

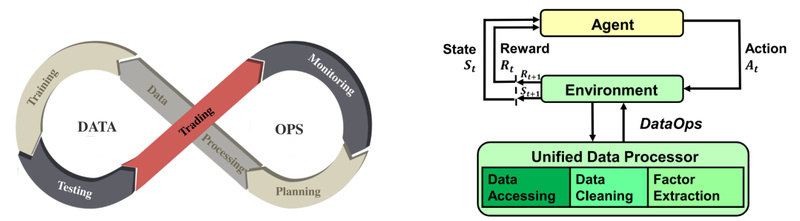

- A DataOps-driven pipeline that automatically ingests, cleans, and structures financial data from diverse global sources.

- Standardized, gym-compatible market environments that enable fair benchmarking and plug-and-play integration with popular RL libraries.

- A clear “Training–Testing–Trading” workflow that enforces temporal separation to prevent data leakage and better approximate real-world performance.

By unifying data, environment, and evaluation under one framework, FinRL-Meta closes the gap between simulation and reality—one of the biggest hurdles in financial AI.

Key Features That Accelerate Development

Hundreds of Pre-Built Market Environments

FinRL-Meta ships with ready-to-use environments covering U.S. equities (via Alpaca, IEX Cloud, Yahoo Finance), Chinese A-shares (via Tushare, Baostock, JoinQuant), and cryptocurrencies (via Binance, CCXT). Each environment is structured as a standard OpenAI Gym environment, complete with observation spaces (OHLCV prices, technical indicators) and action spaces (portfolio allocation decisions).

Automatic Data Curation via DataOps

Instead of manually scraping and cleaning data, FinRL-Meta employs a DataOps paradigm—borrowed from modern DevOps practices—to automate the entire data lifecycle. The pipeline handles:

- Data ingestion from 12+ sources

- Survivorship bias correction

- Technical indicator computation (e.g., MACD, RSI, Bollinger Bands)

- Frequency alignment (from 1-second ticks to daily bars)

This means you get clean, consistent, and bias-aware datasets without writing a single line of preprocessing code.

Plug-and-Play with Leading DRL Libraries

FinRL-Meta is designed for interoperability. You can seamlessly integrate your agent from:

- ElegantRL (for lightweight, GPU-efficient training)

- Stable-Baselines3 (for reliable, well-documented algorithms)

- RLlib (for large-scale, distributed RL experiments)

A single environment can be reused across frameworks, enabling direct performance comparisons and rapid prototyping.

Global Coverage with Flexible Feature Engineering

The library supports assets across the U.S., China, and crypto markets, with data ranging from 1970 (for U.S. equities) to near real-time. Users can also inject custom features—beyond the built-in indicators—by extending the preprocessing layer, ensuring flexibility without sacrificing standardization.

Ideal Use Cases for Researchers and Practitioners

FinRL-Meta shines in scenarios where reproducibility, realism, and efficiency are critical:

- Academic Research: Reproduce published FinRL papers using the exact same environments and datasets provided in the library’s benchmark examples.

- Quant Strategy Prototyping: Test multi-asset portfolio strategies across different markets with minimal setup time.

- Competitions and Collaborations: Participate in community challenges like the ACM ICAIF FinRL Contest, where all participants use the same environment for fair evaluation.

- Education and Onboarding: Leverage the library’s curated Jupyter notebook curriculum—organized from beginner to advanced—to learn financial RL through hands-on examples.

Crucially, FinRL-Meta is not just a simulator; it bridges to real-world execution through paper trading and live trading APIs, making it a practical tool for end-to-end strategy development.

Getting Started: From Training to Simulated Trading

The recommended workflow follows a strict Training–Testing–Trading pipeline:

- Training: Use historical data (e.g., 2015–2020 U.S. stocks) to train your DRL agent.

- Testing: Validate hyperparameters on a held-out period (e.g., 2021–2022) without overlapping with training data.

- Trading: Deploy the agent in out-of-sample backtesting or connect to real-time APIs for paper trading.

This structure prevents common pitfalls like lookahead bias and ensures that performance metrics reflect true generalization.

Dozens of Jupyter notebooks guide you through this process—from loading a Binance crypto environment to training a PPO agent with Stable-Baselines3. The library also supports cloud deployment, allowing you to visualize equity curves, Sharpe ratios, and turnover metrics alongside community benchmarks.

Limitations and Responsible Use

While powerful, FinRL-Meta comes with important caveats:

- Not financial advice: The library is strictly for research, education, and simulation. Never deploy strategies in live markets without rigorous risk controls and professional consultation.

- Data source dependencies: Some providers (e.g., Alpaca, Binance) require API keys or registered accounts. Data frequency and availability vary by source.

- Market realism is imperfect: Historical data cannot capture black-swan events, liquidity shocks, or regime shifts. Performance in simulation does not guarantee real-world success.

- Domain knowledge still matters: FinRL-Meta provides the infrastructure, but effective strategy design requires understanding of financial markets, transaction costs, and risk management.

Always treat simulated results as hypotheses—not guarantees.

Summary

FinRL-Meta removes the biggest barriers to entry in financial reinforcement learning: fragmented data, non-standard environments, and irreproducible results. By offering a DataOps-powered pipeline, gym-compatible market simulators, and seamless integration with leading RL frameworks, it empowers researchers and practitioners to build, test, and share data-driven trading agents with confidence. If you’re exploring quantitative finance with deep reinforcement learning, FinRL-Meta isn’t just a tool—it’s your new foundation.