In today’s fast-moving financial landscape, professionals and developers alike are eager to harness the power of large language models (LLMs). Yet, generic LLMs often stumble when faced with the nuanced demands of finance—interpreting 10-K filings, forecasting stock movements from news, or synthesizing multi-source data into actionable insights. The gap between raw AI capability and real-world financial workflows remains wide.

Enter FinRobot: an open-source AI agent platform purpose-built for financial applications. Unlike general-purpose agent frameworks, FinRobot integrates domain-specific logic, live financial data pipelines, and structured reasoning patterns—so you don’t have to engineer them from zero. Whether you’re a quant developer, a financial analyst, or a researcher exploring AI-driven finance, FinRobot provides ready-to-use tools that respect both the complexity and compliance sensitivity of financial tasks.

Why FinRobot Solves Real Problems in Finance

Financial work isn’t just about data—it’s about structured reasoning under uncertainty. A stock forecast isn’t useful unless it explains why; a trading strategy isn’t actionable unless it accounts for risk, liquidity, and timing. Traditional LLM prompts fail here because they lack scaffolding for financial logic.

FinRobot bridges this gap through Financial Chain-of-Thought (CoT)—a method that breaks complex financial questions into logical, auditable steps. Instead of asking an LLM to “predict NVIDIA’s stock,” FinRobot guides the model to:

- Pull recent financials and news,

- Identify 2–4 key bullish and bearish factors,

- Weigh their relative impact,

- Formulate a directional forecast with justification.

This isn’t just smarter prompting—it’s embedded financial workflow automation.

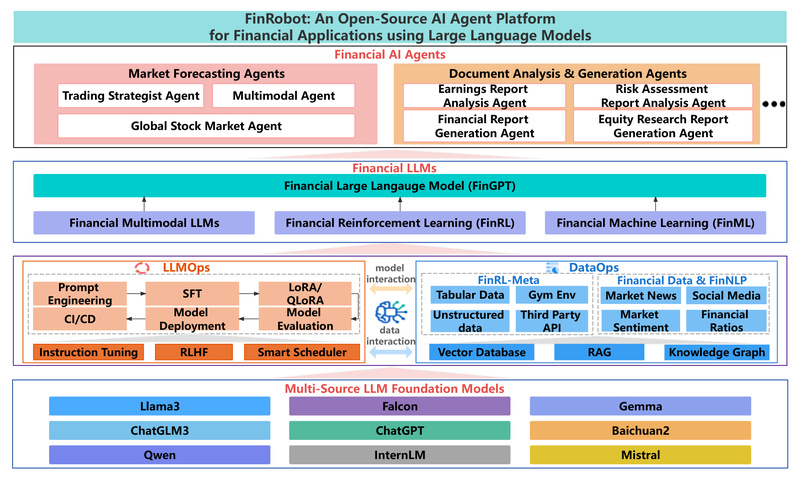

Architecture Designed for Financial Tasks

FinRobot’s power comes from its four-layer architecture, each layer solving a distinct pain point:

Financial AI Agents Layer

This layer hosts specialized agents—Market Forecaster, Document Analyst, Trade Strategist—that use Financial CoT to decompose tasks. Each agent is pre-configured with tool access (e.g., to SEC filings, market feeds) and domain-aware reasoning patterns.

Financial LLM Algorithms Layer

Not all models are equal for finance. This layer dynamically selects or fine-tunes LLM strategies based on the task—e.g., using more conservative temperature settings for forecasting vs. creative report drafting.

LLMOps and DataOps Layer

FinRobot abstracts away data plumbing. It connects to real-world sources like Finnhub, Financial Modeling Prep (FMP), and SEC EDGAR through clean utility modules (finnhub_utils.py, sec_utils.py, etc.), so you work with structured financial data—not raw APIs.

Multi-source LLM Foundation Models Layer

You’re not locked into one model. FinRobot supports plug-and-play integration of various LLMs (e.g., GPT-4, Claude, or open models), letting you swap providers based on cost, latency, or capability.

Practical Use Cases You Can Run Today

FinRobot ships with fully functional notebooks that demonstrate immediate value:

1. Market Direction Forecasting

Provide a ticker like “NVDA,” and FinRobot retrieves live news, financials, and market context. The agent then outputs a concise prediction (e.g., “+2–3% next week”) backed by reasoned analysis—not just a guess.

2. Automated Equity Research Reports

Upload or reference a company’s 10-K filing, and FinRobot generates a 400–450 word professional report—including financial ratio analysis, risk assessment, and visualizations (e.g., EPS trends)—then compiles it into a PDF. All steps follow a transparent CoT workflow.

3. Multimodal Trade Strategy Design

Combine chart patterns (via mplfinance), technical indicators, and fundamental data to prototype strategies like SMA crossovers. The agent reasons across text and visual data to propose, backtest, and document a strategy—ideal for rapid iteration.

Getting Started Is Deliberately Simple

FinRobot lowers the barrier to entry:

- Install via

pip install -U finrobotor from source. - Add your API keys (OpenAI, Finnhub, FMP, SEC) using the provided templates.

- Run any of the included notebooks in

tutorials_beginner/.

The codebase is modular: agents live in agents/, data connectors in data_source/, and core functions (charting, coding, quantitative analysis) in functional/. This structure lets beginners use pre-built agents while enabling developers to extend or customize components.

How FinRobot Stands Out Among AI Agent Frameworks

Many open-source agent platforms exist—AutoGen, LangChain, MetaGPT—but they’re general-purpose. FinRobot is different because it’s financially native:

- Pre-built financial agents eliminate months of scaffolding.

- Integrated data pipelines mean no manual JSON wrangling from SEC or FMP APIs.

- Financial CoT enforces disciplined reasoning expected in professional finance.

You could build this yourself on LangChain—but why reinvent regulatory-compliant financial workflows when FinRobot provides them out of the box?

Limitations and Responsible Use

FinRobot is powerful but comes with clear boundaries:

- It relies on external APIs (e.g., Finnhub, OpenAI), which may incur costs.

- Outputs are for informational and research purposes only—not financial advice.

- Model performance depends on LLM quality; hallucinations remain possible.

The project includes disclaimers and encourages users to validate outputs with domain experts before any real-world application.

Summary

FinRobot isn’t just another LLM wrapper. It’s a purpose-built platform that embeds financial domain logic, live data access, and structured reasoning into reusable AI agents. For project leads, researchers, and developers evaluating AI tools for finance, it offers a rare combination: open-source flexibility, domain-specific utility, and immediate hands-on value. If your goal is to prototype, test, or deploy financial AI without rebuilding the wheel, FinRobot provides the foundation you need—today.